Homeowner Incentives

At Koala Insulation, our goal has always been simple: help homeowners create more comfortable, energy-efficient homes while reducing energy costs and saving money. Over the past few years, federal and state programs have made incentives available to help homeowners offset the cost of insulation upgrades.

While some programs have ended like the Inflation Reduction Act, many homeowners can still file for past credits, and state-specific rebates may still be available.

Learn which incentives were available, how to file if you qualify, and where to find state and local rebates.

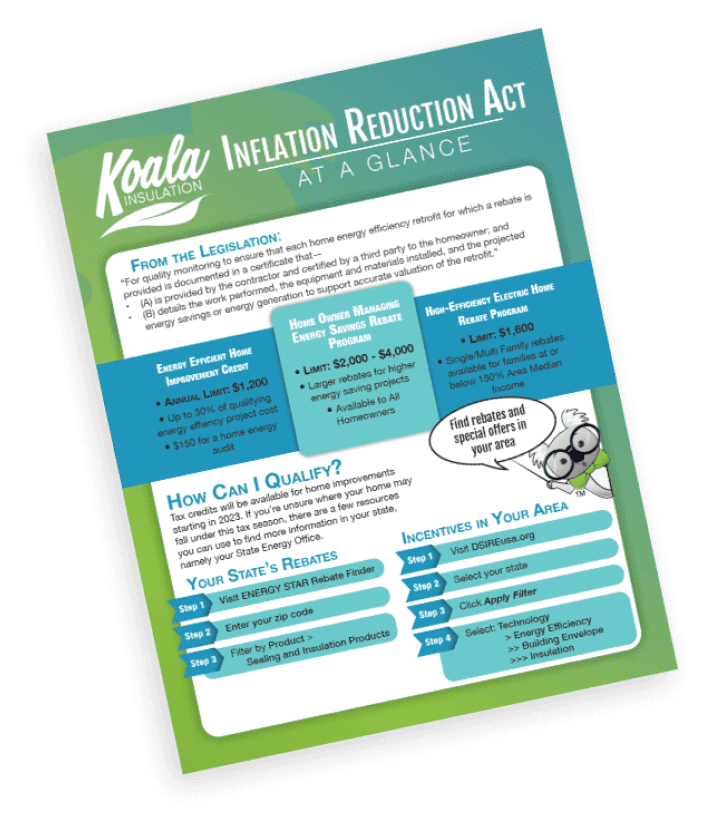

Inflation Reduction Act (IRA) – What Homeowners Should Know

Koala Insulation continues to share this information as a helpful resource for homeowners who are filing their taxes or exploring state-level rebate opportunities.

Energy Efficiency Home Improvement Credit (Section 25C)

- Up to 30% of the cost of qualifying insulation materials and labor

- Up to $1,200 per year as a federal tax credit

How to File If Your Insulation Was Installed in 2025

If you had insulation installed within the last tax year, you may still be able to file for this credit when completing your federal tax return.

Koala Insulation can help by:

- Providing clear invoices and project documentation

- Explaining which insulation upgrades previously qualified

- Walking you through what information is typically needed to file

To claim the credit, homeowners generally:

- File IRS Form 5695 with their federal tax return

- Use their Koala Insulation invoice and project details

- Report eligible insulation costs under the Energy Efficiency Home Improvement Credit section

HOMES Rebate Program (State-Administered)

Key things to know:

- Rebates were based on measured or modeled energy savings

- A minimum 20% energy reduction was typically required

- Programs were run by individual states, not the federal government

High-Efficiency Electric Home Rebate Program

Rebate amounts were based on:

- Overall project cost

- Energy savings achieved

- State-specific program guidelines

How to Find State-Specific Rebates

To find rebates in your area:

2. Check your state energy office website

3. Review local utility company efficiency programs

4. Confirm eligibility requirements and available funding

How Koala Insulation Supports You

- Providing clear invoices and documentation

- Explaining which insulation upgrades previously qualified for incentives

- Helping you understand what paperwork may be needed

- Directing you to reliable federal and state resources

Our goal is to make the process clearer and less overwhelming.

Frequently Asked Questions

Can I still file for a tax credit if my insulation was installed in 2025?

Yes, homeowners may still be able to file for qualifying credits when completing their federal tax return.

How do I know if my state still offers rebates?

State energy offices, utility providers, and Energy Star’s rebate finder are the best places to check current availability.

Is the filing process complicated?

Federal tax credits typically require IRS Form 5695 and proper documentation. State rebates vary by program.

Can incentives be combined?

In some cases, homeowners were able to combine federal credits with state or utility rebates, depending on program rules.

Get a quote