The Inflation Reduction Act

The Inflation Reduction Act (IRA) was passed by the Senate on August 7 and signed into law on August 16. Within this 10-year plan, new funds are going to be allocated to rebate programs and other funding mechanisms aimed at providing support to efficiency improvements. For homeowners, this just increased your return on investment opportunities for energy efficiency upgrades throughout the house.

What This Means for Insulation & Homeowners

One of the most significant ways this bill affects homeowners is in the effort to encourage eco-friendly products and services while also helping clean energy production.

Energy Efficient Home

Improvement Credit

Annual Limit

$1200

If you’re familiar with the Nonbusiness Energy Property Credit that ended in 2021, you may already be aware of the tax credits homeowners can claim on certain purchases. This has a similar role with new and improved initiatives. Essentially, you’ll be able to reduce your tax bill when you make energy-efficient upgrades to your home and appliances.

When you purchase upgrades on energy-saving installations like insulation, windows, doors, and other building changes, you can claim 30% of the cost starting in 2023. The previous credit system (the Nonbusiness Energy Property Credit) had a $500 lifetime limit; this has been replaced by a $1,200 annual limit with various annual limits changes for certain types of qualifying improvements.

The HOMES (Home Owner Managing Energy Savings) Rebate Program

This program is designed to help provide cash back through reducing overall energy use in your household. By making home improvements such as adding insulation, you’ll earn money back based on how much you’re projected to save. This is determined by an energy audit with DOE-approved software. The amount you receive is determined by the amount of energy you’ve saved, your projected (modeled) savings, and household income.

There are 3 rebate amounts you can earn from, earning the lesser of either 50% of the project cost or the following:

Measured Energy Savings

< 20%

Modeled Energy Savings

20%-35%

Modeled Energy Savings

> 35%

The more you save, the more you’re able to receive!

High-Efficiency Electric

Home Rebate Program

Annual Limit

$1600

In an effort to encourage households to make environmentally friendly choices, rebates within the HOMES program will be offered to low- and middle-income families for certain purchases. If your total annual income is less than 150% of the median income in your area, you’ll qualify for rebates on energy-efficient renovations and appliances. For insulation, air sealing, and ventilation, specifically, your household can get up to $1,600 in rebates for your purchases. There are a few limits and additional qualifications, so make sure you meet the requirements before setting out on a major home improvement project.

Single-Family Homes

Individuals and single-family homes will be able to take significant advantage of these opportunities. Noncommercial homes qualify for the Energy Efficient Home Improvement Credit, including if you’re renting or living in a multifamily building. The HOMES Rebate Program provides cashback through renovations like insulation and efficient appliances and is dependent on how much you save. The High-Efficiency Electric Home Rebate Act is the section that is only available to low- to medium-income families.

Multifamily Homes

Opportunities for multifamily development have increased under the IRA. The $1 billion for a HUD-led program goes toward loans and grants for improving energy and water efficiency. This provides relief to utilities bills and climate disaster preparedness, especially in low-income communities. The Green and Resilient Retrofit Program combines direct loan subsidies and competitive grants to support improvements made to multifamily properties.

How Can I Qualify?

Tax credits will be available for home improvements starting in 2023. If you’re unsure where your home may fall under this tax season, there are a few resources you can use to find more information in your state. Your State Energy Office can also provide more information on when you can expect certain incentives to start being offered and supported in 2023.

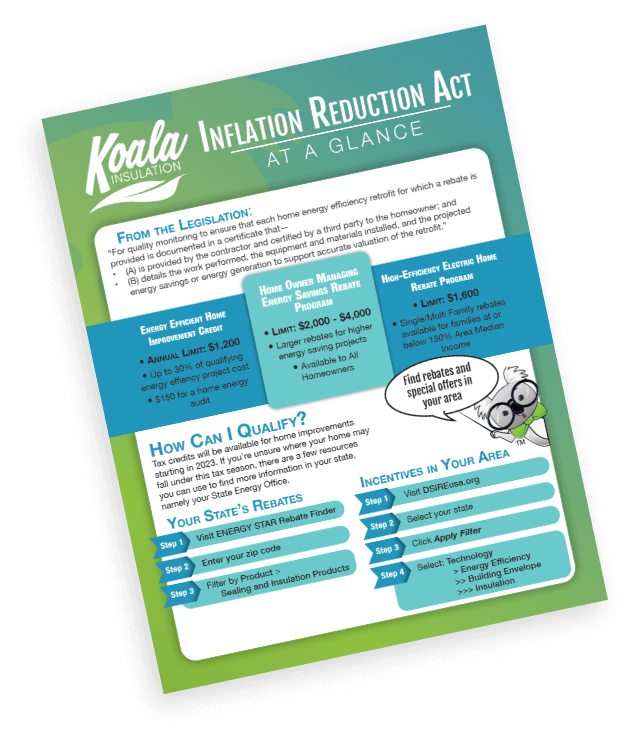

Downloadable Infographic

This will contain a summarization of the information above, including a breakdown of each home and where they can find more information within their state.