The Hidden Financial Truth: Why Insulation Creates Wealth While Kitchen Remodels Create Memories

A Financial Analysis of Two Very Different Home Investments

Executive Summary

When homeowners consider major upgrades, they often compare fundamentally different types of investments without realizing it. Kitchen remodels and insulation upgrades operate on entirely different financial principles and deserve different evaluation methods.

This comprehensive analysis reveals why insulation functions as a perpetual income stream while kitchen remodels, though valuable for lifestyle and enjoyment, typically result in immediate financial losses with no offsetting income generation.

Key Finding: A $5,000 insulation investment in an average Atlanta home can generate $14,410-$22,970 in total lifetime value, while a $20,000 kitchen remodel typically recovers only $19,200 in home value—an immediate loss of $800 with no monthly savings to offset it.

Quick Summary for Busy Homeowners

The Bottom Line:

- Kitchen remodels bring joy but lose money (4-62% immediate loss)

- Insulation saves money every month forever ($36-$71/month in Atlanta)

- With tax credits, insulation can return 279-505% over its lifetime

- Kitchen remodels = buying happiness; Insulation = buying income

What This Means for You:

- If you love cooking and entertaining, a kitchen remodel might be worth the cost for lifestyle reasons

- If you want to build wealth through your home, insulation offers guaranteed returns

- You can do both—but understand which one is the investment

Understanding the Real Difference Between ROI and Cost Recovery

The home improvement industry often confuses homeowners by misusing the term “ROI” (Return on Investment). When Remodeling Magazine reports a kitchen remodel has “96% ROI,” they’re actually describing something different1.

The Critical Distinction:

True ROI Formula: ROI = (Gain – Cost) / Cost × 100

What the Industry Calls “ROI”: Cost Recovery = Value Added / Cost × 100

Real-World Example:

Let’s look at a typical minor kitchen remodel:

- Investment: $20,000

- Home value increase: $19,200 (96% “ROI” per industry)2

- Actual ROI: ($19,200 – $20,000) / $20,000 = -4%

- Reality: You’ve spent $20,000 to add $19,200 in value

This isn’t necessarily bad—many homeowners gladly pay $800 for years of enjoyment in a beautiful kitchen. But it’s important to understand this is consumption, not investment.

Kitchen Remodels: The Luxury Purchase That Improves Your Life

While kitchens bring aesthetic joy and family connection, they often fail to offer meaningful financial returns. Like buying a luxury car, kitchen remodels provide immediate satisfaction but come with financial realities:

- Immediate Value Gap: The moment work is complete, you’ve typically lost money

- No Income Generation: Beautiful countertops don’t reduce monthly bills

- Maintenance Requirements: New appliances need upkeep and eventual replacement

- Style Evolution: Today’s trends may look dated in 10 years

The Financial Reality:

According to the 2024 Cost vs. Value Report3:

- Minor kitchen remodel: 96% cost recovery (4% loss)

- Major kitchen remodel: 50% cost recovery (50% loss)

- Upscale kitchen remodel: 38% cost recovery (62% loss)

Important Note: These aren’t failures—they’re the price of lifestyle enhancement. Many families find tremendous value in gathering spaces, even at a financial cost.

Insulation: The Quiet Wealth Builder

Insulation operates as both an appreciating asset AND an income-generating investment. While it lacks the visual appeal of granite countertops, it delivers something more valuable: predictable, perpetual returns.

Important Assumptions:

All calculations assume properly installed insulation in a home with average HVAC performance. Individual results vary based on home size, current insulation levels, HVAC condition, and usage patterns. The ranges shown are based on EPA studies and typical Atlanta climate conditions.

The Dual Value Creation Model:

1. Immediate Asset Appreciation

- Investment: $5,000

- Home value increase: $5,850 (117% based on industry data)4

- Immediate gain: $850

2. Perpetual Energy Savings

Real Atlanta Home Example (1500-2000 sq ft, built before 2000):

- Current energy bills: $238/month ($2,856/year)

Conservative Scenario (15% savings)5:

- After insulation: $202/month ($2,428/year)

- Annual savings: $428

- Monthly cash flow: $36

Optimal Scenario (30% savings)6:

- After insulation: $166/month ($2,000/year)

- Annual savings: $856

- Monthly cash flow: $71

Duration: As long as your home stands (typically 30+ years with proper installation)

The Power of Monthly Savings: A 30-Year View

Let’s examine what happens to a typical Atlanta home over time:

Starting Point:

- Home: 1500-2000 sq ft, built before 2000

- Current bills: $238/month

- 30-year energy cost projection: $85,680

After Professional Insulation:

Conservative Results (15% reduction):

- New monthly bills: $202

- Monthly savings: $36

- 10-year total savings: $4,280

- 20-year total savings: $8,560

- 30-year total savings: $12,960

Optimal Results (30% reduction):

- New monthly bills: $166

- Monthly savings: $71

- 10-year total savings: $8,560

- 20-year total savings: $17,120

- 30-year total savings: $25,920

Note: These assume flat energy rates. With typical 2-3% annual energy inflation7, actual savings would be 40-60% higher.

Financial Analysis: Understanding Perpetuity Value

For the Financially Curious: How Perpetuities Work

A perpetuity is an investment that pays forever. Think of it like a bond that never matures or a dividend stock you never sell. The formula is elegantly simple:

Present Value = Annual Payment ÷ Discount Rate

Calculating Insulation’s True Value:

Conservative Scenario (15% savings):

- Annual energy savings: $428

- Discount rate: 5% (typical for low-risk investments)8

- Present value of savings: $428 ÷ 0.05 = $8,560

Optimal Scenario (30% savings):

- Annual energy savings: $856

- Discount rate: 5%

- Present value of savings: $856 ÷ 0.05 = $17,120

Total Investment Value:

- Initial investment: $5,000

- Home value increase: $5,850

Conservative (15% savings):

- Present value of energy savings: $8,560

- Total value created: $14,410

- True ROI: 188%

Optimal (30% savings):

- Present value of energy savings: $17,120

- Total value created: $22,970

- True ROI: 359%

Accounting for Energy Inflation: The Growing Perpetuity

Energy costs typically rise faster than general inflation. Using the growing perpetuity formula9:

PV = Initial Cash Flow ÷ (Discount Rate – Growth Rate)

Conservative (15% savings):

- Initial savings: $428/year

- With 2% energy inflation: PV = $428 ÷ (0.05 – 0.02) = $14,267

Optimal (30% savings):

- Initial savings: $856/year

- With 2% energy inflation: PV = $856 ÷ (0.05 – 0.02) = $28,533

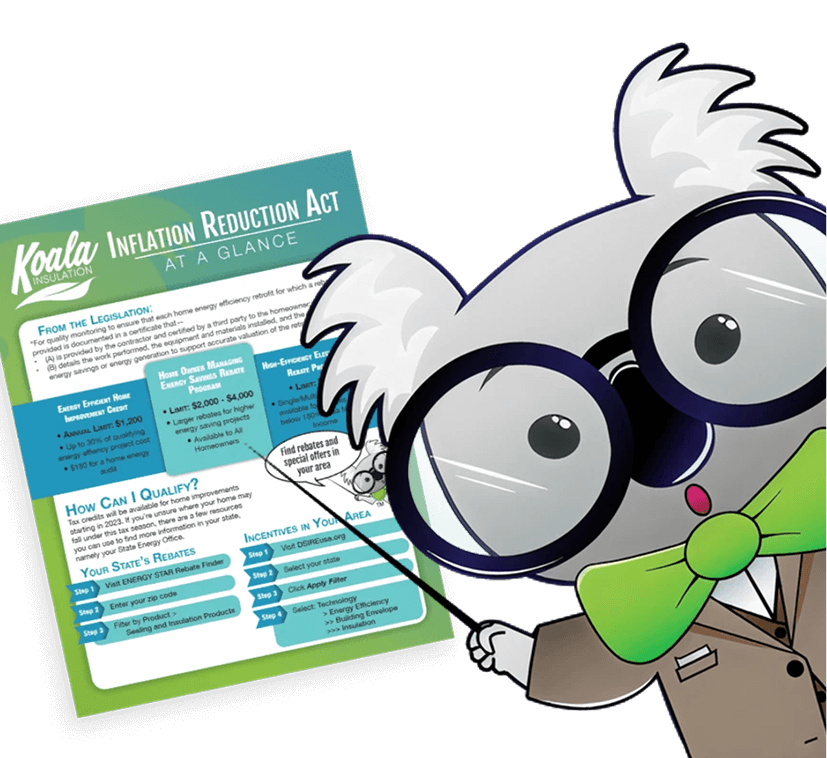

Tax Credits Make the Decision Even Clearer

Current Federal Incentives (2024-2025)10:

- Insulation: 30% tax credit up to $1,200

- Kitchen remodel: $0 tax credit

After-Tax Investment Returns:

- Actual insulation cost: $5,000 – $1,200 = $3,800

- Adjusted ROI (conservative): 279%

- Adjusted ROI (optimal): 505%

Side-by-Side Comparison: 30 Years Later

Starting Point:

Atlanta home with $238/month energy bills

| Investment Type | Initial Cost | Immediate Gain/Loss | 30-Year Energy Cost | Total 30-Year Position |

| Do Nothing | $0 | $0 | $85,680 | -$85,680 |

| Kitchen Remodel | $20,000 | -$800 | $85,680 | -$106,480 |

| Insulation (15%) | $5,000 | +$850 | $72,720 | -$76,870 |

| Insulation (30%) | $5,000 | +$850 | $59,760 | -$63,910 |

The Difference: Choosing insulation over a kitchen remodel saves $29,610-$42,570 over 30 years.

Risk Comparison: Which Investment Is Safer?

Kitchen Remodel Risks:

- Style risk: Trends change; today’s “modern” is tomorrow’s “dated”11

- Execution risk: Poor workmanship can destroy value

- Market risk: Buyer preferences vary widely

- No downside protection: Money spent cannot be recovered

Insulation Investment Risks:

- Minimal style risk: Hidden from view, always in demand

- Low execution risk: Established methods, measurable results12

- No market risk: Energy savings are universal

- Natural hedge: Rising energy costs increase your returns

Why Do Smart People Choose Poor Investments?

Behavioral economics explains why homeowners often choose financially inferior options13:

- Visibility Bias: We value what we see daily over hidden benefits

- Social Influence: Instagram kitchens get likes; insulation doesn’t

- Present Bias: Immediate gratification trumps future savings

- Complexity Aversion: Monthly savings are easier to understand than perpetuity values

Understanding these biases helps make better decisions.

A Decision Framework for Your Home

Choose Insulation When:

✓ You want guaranteed monthly savings

✓ You value building wealth through your home

✓ You plan to stay 2+ years

✓ You want to hedge against rising energy costs

✓ You seek low-risk returns

Choose a Kitchen Remodel When:

✓ You value lifestyle enhancement over returns

✓ Your current kitchen significantly impacts quality of life

✓ You understand and accept the financial cost

✓ You’re creating your forever home

✓ The joy it brings is worth the investment

Consider Both When:

✓ You have the budget for both projects

✓ You want comfort AND beauty

✓ You can do insulation first (to size HVAC properly)

Environmental Benefits: The Value Beyond Dollars

Insulation provides benefits that increasingly affect property values14:

- Carbon reduction: Lower energy use = smaller footprint

- Grid stability: Reduced peak demand helps everyone

- Resource conservation: Less energy generation needed

- Future carbon markets: Potential for credits as markets develop

The Professional Perspective

Institutional real estate investors prioritize insulation and energy efficiency15. Why?

- Predictable returns: Energy savings are contractual

- Low volatility: Performance doesn’t depend on trends

- Scalability: Works across entire portfolios

- ESG compliance: Meets environmental mandates

No REIT renovates kitchens for financial returns—they do it for tenant retention.

Your Next Steps

The choice between insulation and kitchen remodeling isn’t really about choosing the “better” investment—it’s about understanding what you’re buying:

- Insulation: You’re buying a perpetual income stream

- Kitchen Remodel: You’re buying years of enjoyment

Both can be right for your home. The key is making an informed decision.

Ready to Start Building Wealth Through Energy Savings?

Contact Koala Insulation for a free energy analysis. We’ll show you:

- Your home’s specific savings potential

- Current insulation levels and improvement opportunities

- Available tax credits and rebates

- Expected ROI based on your actual energy use

Turn your home into a perpetual savings machine—starting with just one phone call.

References

Methodology: Calculations based on EPA estimates, industry reports, and standard financial formulas. Discount rates reflect current risk-free rates plus appropriate risk premiums. Individual results vary based on home characteristics and energy use patterns.

Disclaimer: This analysis examines financial returns only. Kitchen remodels provide significant lifestyle value that many homeowners find justifies the cost. Always consider both financial and personal factors in home improvement decisions.

Footnotes

- Remodeling Magazine. (2024). Cost vs. Value Report. Hanley Wood Media. https://www.remodeling.hw.net/cost-vs-value/2024/ ↩

- Angi. (2024). How Much Does a Kitchen Remodel Increase Home Value? https://www.angi.com/articles/how-much-does-a-kitchen-remodel-increase-home-value.htm ↩

- Remodeling Magazine. (2024). 2024 Cost vs. Value Report: Kitchen Remodeling ROI. https://www.remodeling.hw.net/cost-vs-value/2024/ ↩

- North American Insulation Manufacturers Association. (2016). Insulation ROI Study. https://information.insulationinstitute.org/blog/whats-the-roi-of-attic-insulation ↩

- U.S. Environmental Protection Agency. (2023). Methodology for Estimated Energy Savings from Insulation. https://www.energystar.gov/saveathome/seal_insulate/methodology ↩

- RetroFoam of Michigan. (2024). Energy Savings Explained. https://www.retrofoamofmichigan.com/blog/total-lifetime-cost-of-foam-insulation ↩

- U.S. Energy Information Administration. (2024). Annual Energy Outlook 2024. https://www.eia.gov/outlooks/aeo/ ↩

- Damodaran, A. (2024). Historical Returns on Stocks, Bonds and Bills. NYU Stern School of Business. https://pages.stern.nyu.edu/~adamodar/ ↩

- Ross, S., Westerfield, R., & Jordan, B. (2022). Fundamentals of Corporate Finance (13th ed.). McGraw-Hill Education. ↩

- U.S. Department of Energy. (2024). Federal Tax Credits for Energy Efficiency. https://www.energy.gov/save/home-upgrades ↩

- National Association of Realtors. (2023). 2023 Remodeling Impact Report. https://www.nar.realtor/ ↩

- Building Performance Institute. (2024). Standards for Home Performance. https://www.bpi.org/ ↩

- Kahneman, D. (2011). Thinking, Fast and Slow. Farrar, Straus and Giroux. ↩

- ICF International. (2022). Insulation Upgrades Save Energy and Emissions. https://www.buildingenclosureonline.com/ ↩

- National Association of Real Estate Investment Trusts. (2023). 2023 REIT Industry ESG Report. https://www.reit.com/ ↩

Find Your Location

Get a quote