What is the Energy Efficiency Home Improvement Credit?

As homeowners look for ways to reduce utility bills and improve energy efficiency, many are discovering that insulation upgrades not only save money over time but also qualify for valuable tax incentives. One of the most beneficial programs currently available is the Energy Efficiency Home Improvement Credit, a federal tax credit designed to reward energy-saving improvements.

At Koala Insulation Orlando Central, we help homeowners across Central Florida make smart, cost-effective insulation choices—and understand how to take advantage of incentives like this one. If you’re thinking about upgrading your insulation, now is the perfect time to do it.

In this blog, we’ll break down everything you need to know about the Energy Efficiency Home Improvement Credit: what it is, who qualifies, how it works, and how Koala Insulation can help you maximize your savings.

What is the Energy Efficiency Home Improvement Credit?

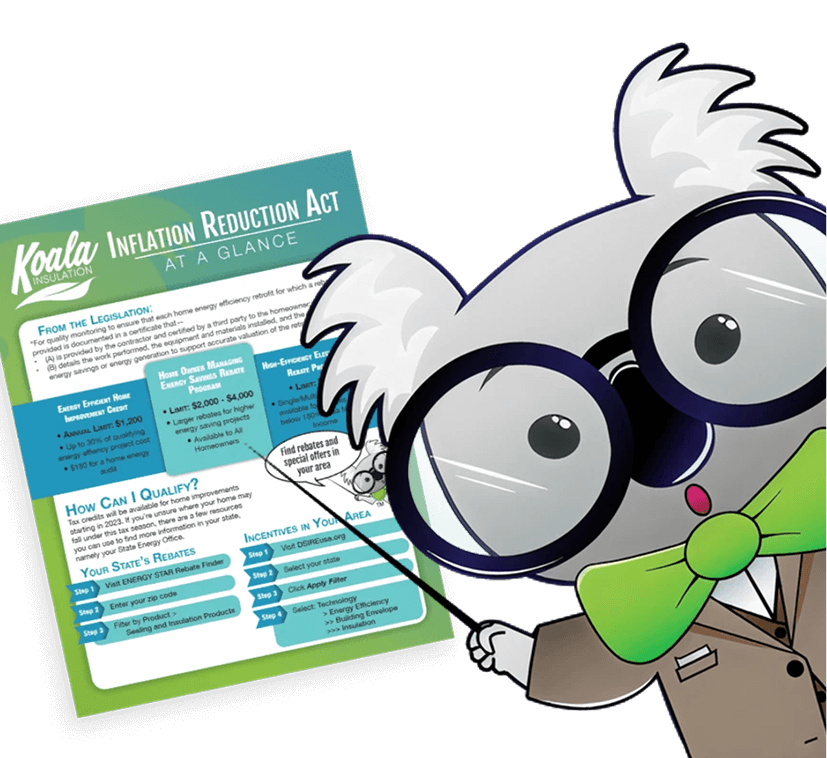

The Energy Efficiency Home Improvement Credit is a federal tax credit provided by the IRS to encourage homeowners to make energy-saving upgrades to their homes. This program was expanded and extended through the Inflation Reduction Act of 2022, making it more accessible and valuable than ever.

Previously known as the Nonbusiness Energy Property Credit, the new version offers a credit of up to 30% of the cost of qualified improvements, with annual limits on different categories of upgrades.

What Improvements Qualify?

A wide range of energy-efficient upgrades may be eligible under this credit. These include:

- Insulation (spray foam, blown-in, batt)

- Energy-efficient windows and doors

- Air sealing improvements

- Advanced HVAC systems

- Heat pumps

- Water heaters

- Home energy audits

At Koala Insulation Orlando Central, we focus specifically on insulation and air sealing—two of the most effective and affordable upgrades for reducing home energy usage and increasing indoor comfort.

How Much Can You Save?

Here’s how the credit breaks down for insulation-related upgrades:

- 30% of the material costs for qualified insulation products (spray foam, fiberglass batts, blown-in cellulose, etc.)

- Maximum of $1,200 per year in total credits for all eligible improvements

- Can be claimed year after year, starting in 2023, as long as you stay within the annual caps

Unlike some rebates or deductions, this is a direct tax credit—meaning it reduces your tax liability dollar-for-dollar. For example, if your qualifying insulation upgrade cost $3,000 in materials, you could receive a $900 credit.

Eligibility Requirements

To qualify for the Energy Efficiency Home Improvement Credit:

- The home must be your primary residence (rentals and second homes don’t qualify).

- The home must be located in the United States.

- The improvements must meet specific energy efficiency standards outlined by the Department of Energy.

- You must install the upgrades yourself or hire a professional contractor—like Koala Insulation Orlando Central.

Note: Labor costs for insulation do not qualify for the tax credit—only the cost of materials can be claimed.

Why Insulation is a Smart Choice for the Credit

Out of all the eligible upgrades, insulation is one of the most cost-effective and impactful ways to improve your home’s energy efficiency. Here’s why:

- Insulation helps maintain indoor temperatures, reducing the need for heating and cooling.

- It can cut energy bills by 15% or more, especially in Florida homes where summer heat puts a strain on HVAC systems.

- It’s a relatively affordable improvement with long-term returns in comfort and savings.

- It complements other improvements like smart thermostats or upgraded HVAC systems.

How Koala Insulation Orlando Central Can Help

At Koala Insulation Orlando Central, we specialize in energy-efficient insulation upgrades, including:

- Spray foam insulation (ideal for attics, crawl spaces, and walls)

- Blown-in cellulose and fiberglass

- Batt insulation for walls and floors

- Air sealing to eliminate drafts and hot spots

We help homeowners choose the best insulation for their needs and budget, and we always ensure our materials meet the energy efficiency standards required for tax credit eligibility.

When you work with us, we’ll:

- Evaluate your home’s insulation needs

- Recommend the right products and R-values

- Provide itemized invoices that separate material and labor costs for tax documentation

- Ensure your installation is done cleanly, quickly, and professionally

How to Claim the Credit

When tax season rolls around, here’s what you’ll need to do:

- Save your receipts: Keep detailed documentation of the insulation materials you purchased.

- Request a Manufacturer’s Certification Statement, if available, to confirm that the product meets DOE standards.

- Complete IRS Form 5695 (Residential Energy Credits) and file it with your federal tax return.

- Apply the credit toward your tax bill or refund.

If you’re working with an accountant, provide them with your receipts and product certifications. Koala Insulation Orlando Central will make this step easy by giving you the documentation you need.

FAQs About the Energy Efficiency Home Improvement Credit

Q: Can I claim the credit if I already claimed it in previous years?

A: Yes! This credit resets annually, so homeowners can claim it each year through 2032, subject to annual caps.

Q: Does spray foam insulation qualify?

A: Yes. Both open-cell and closed-cell spray foam insulation qualify, as long as they meet required energy performance standards.

Q: What if I install insulation in a newly built home?

A: This credit applies only to existing homes used as a primary residence—not to new construction.

Conclusion

The Energy Efficiency Home Improvement Credit makes it easier and more affordable than ever to upgrade your home’s insulation and reduce energy bills. With the hot Orlando summers, now is the time to boost your home’s comfort and efficiency with high-performance insulation.

Call Koala Insulation Orlando Central today at (407) 743-3487 or visit https://koalainsulation.com/orlando-central for a free estimate. We’ll help you choose the right solution and guide you through the process of qualifying for your tax credit.

Stay cool, save energy, and earn money back—it’s a win all around!

Find Your Location

Get a quote